If the calculation shows that you need to sell 769 units to break even, any units sold beyond this point contribute to net profit. To calculate the break-even point in terms of total sales dollars, multiply the break-even units by the selling price per unit. In this case, 769 units at $20 per unit would require total sales of $15,380 to break even. Let’s say the fixed costs are \($10,000\), the selling price per unit is \( $50\), and the variable cost per unit is \($30\).

What is Free Margin in FX Trading?

Once you crunch the numbers, you might find that you have to sell a lot more products than you realized to break even. You might wonder, “What is a good BEP?” The answer largely depends on your industry, cost structure, and business model. A “good” break-even point allows you to cover your costs quickly and start generating profit. While break-even analysis is a powerful tool for understanding costs and sales dynamics, several additional factors must be considered for a more comprehensive financial evaluation. Performing a regular break-even analysis is essential for maintaining financial health, especially in periods of growth or economic uncertainty. This means you need to sell approximately 769 units to cover your costs.

How can I estimate the revenue per download for my mobile app?

A business’s break-even point is the stage at which revenues equal costs. Once you determine that number, you should take a hard look at all your costs — from rent to labor to materials — as well as your pricing structure. Fixed Costs – Fixed costs are ones that typically do not change, or change only slightly. Examples of fixed costs for a business are monthly utility expenses and rent. Businesses with higher contribution margins can break even with fewer sales, whereas those with lower margins may need significantly higher volumes to cover their fixed costs.

Total solar system cost

It’s a good idea to calculate your break-even point periodically, especially when there are changes in costs or pricing. As with most business calculations, it’s quite common that different people have different needs. For example, your break-even point formula might need to be accommodate costs that work in a different way (you get a bulk discount or fixed costs jump at certain intervals). Break-even analysis looks at fixed costs relative to the profit earned by each additional unit produced and sold. A higher contribution margin means fewer downloads are needed to cover fixed costs.

Business Planning

The contribution margin is determined by subtracting the variable costs from the price of a product. In addition, break-even analysis helps make decisions about scaling production. If a business is considering expanding, break-even analysis provides insights into how much additional production is needed to make the investment worthwhile.

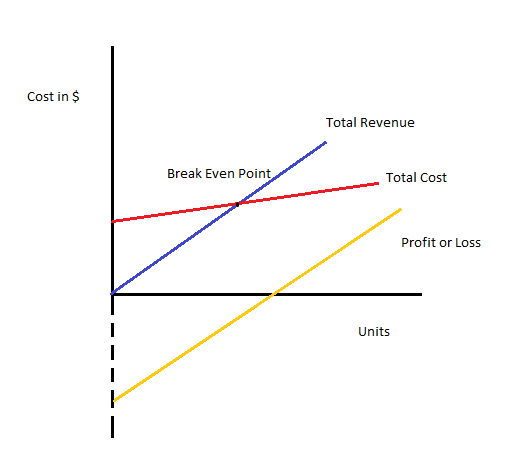

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. This section provides an overview of the methods that can be applied to calculate the break-even point. Our Break-Even Point Calculator makes it easy to understand your business’s child tax credit financial situation and make informed decisions. So, the break even point corresponds to the number of units you need to sell in order to break even. If you sell less than that, you make a loss, and if you sell more than that, you make a profit. Once you know the number of break even units, it will give you a target which you and your staff can aim towards.

You sell each item for $50, and it costs you $20 in materials and labor to make each item. You also have fixed costs of $2,000 per month to cover rent, utilities, and other expenses. First we need to calculate the break-even point per unit, so we will divide the $500,000 of fixed costs by the $200 contribution margin per unit ($500 – $300). The break even analysis helps you calculate out your break-even point. Upon selling 500 units, the payment of all fixed costs is complete, and the company will report a net profit or loss of $0. Break-even analysis is a crucial tool for businesses of all sizes, as it helps in understanding the relationship between costs, sales, and profits.

- Balancing marketing spend with expected returns is crucial for financial success.

- All you need to do is provide information about your fixed costs, and your cost and revenue per unit.

- If your roof has room for lots of panels that soak in the sun all day, you’ll produce a ton of electricity and see a quicker payback.

- In such cases, break-even analysis will help you to decide on new prices for your products.

- If you consume a lot of electricity, solar might only translate to a small reduction in your electricity costs, which means it could take longer for you to see a return on your investment.

- This is a step further from the base calculations, but having done the math on BEP beforehand, you can easily move on to more complex estimates.

The fixed costs are a total of all FC, whereas the price and variable costs are measured per unit. Easily calculate the break even point for any product or service and generate a graph with the break-even point. Estimate how many units you need to sell before you break even, covering both your fixed and variable costs, and how long it would take you. This break-even calculator allows you to perform a task crucial to any entrepreneurial endeavor.

We use the formulas for number of units, revenue, margin, and markup in our break-even calculator which conveniently computes them for you. If your price is too high, you might be falling short of your break-even point because customers won’t buy at that price. Lowering your selling price will increase the sales needed to break even. But this can be offset by the increased volume of purchases from new customers. The break-even point (BEP) is the amount of product or service sales a business needs to make to begin earning more than you spend. You measure the break-even point in units of product or sales of services.

0 comments